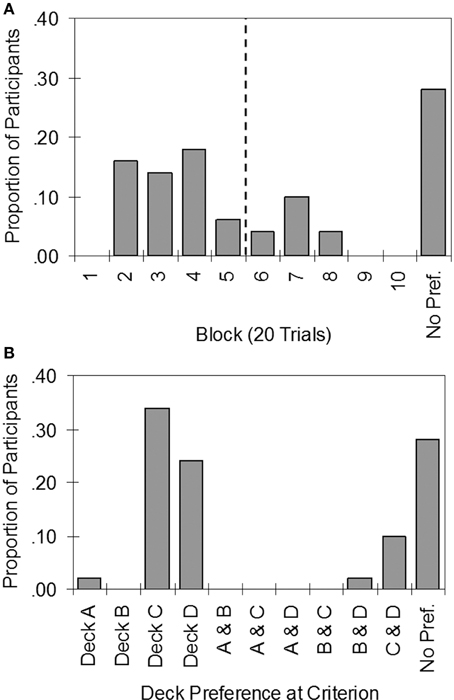

The task was originally presented simply as the Gambling Task, or the 'OGT'. Later, it has been referred to as the Iowa gambling task and, less frequently, as Bechara's Gambling Task. The Iowa gambling task is widely used in research of cognition and emotion. A recent review listed more than 400 papers that made use of this paradigm. The Iowa Gambling Task (IGT; Bechara et al., 1994) was designed to assess decision-making abilities in VMPFC patients under such conditions of complexity and uncertainty. Participants are instructed to maximize winnings while choosing repeatedly from four decks of playing cards that unpredictably yield wins and losses.

You must report the full amount of gambling winnings. Report any Iowa tax withheld on IA 1040, line 63. Gambling losses may be reported as an itemized deduction on Schedule A, but you cannot deduct more than the winnings you report.

Gambling losses: Gambling losses are deductible on IA 1040, Schedule A, line 25, only to the extent of gambling winnings reported on IA 1040, line 13. The gambling loss amount entered on IA 1040, Schedule A, line 25, shall only include losses from wagering transactions, and does not extend to business expenses incurred in the trade or business of gambling.

The task was originally presented simply as the Gambling Task, or the 'OGT'. Later, it has been referred to as the Iowa gambling task and, less frequently, as Bechara's Gambling Task. The Iowa gambling task is widely used in research of cognition and emotion. A recent review listed more than 400 papers that made use of this paradigm. The Iowa Gambling Task (IGT; Bechara et al., 1994) was designed to assess decision-making abilities in VMPFC patients under such conditions of complexity and uncertainty. Participants are instructed to maximize winnings while choosing repeatedly from four decks of playing cards that unpredictably yield wins and losses.

You must report the full amount of gambling winnings. Report any Iowa tax withheld on IA 1040, line 63. Gambling losses may be reported as an itemized deduction on Schedule A, but you cannot deduct more than the winnings you report.

Gambling losses: Gambling losses are deductible on IA 1040, Schedule A, line 25, only to the extent of gambling winnings reported on IA 1040, line 13. The gambling loss amount entered on IA 1040, Schedule A, line 25, shall only include losses from wagering transactions, and does not extend to business expenses incurred in the trade or business of gambling.

Iowa Gambling Task Online

Married Separate Filers: The spouse to whom the income was paid must report that income. |